Hello friends,

The “Mishtann Foods” tale is a stark reminder of the value of self-research and conviction while investing. What later unraveled was meticulously designed practices deployed to manipulate the retail investors.

After SEBI issued an interim order citing financial fraud, Mishtann Foods' share price dropped significantly. Before we discuss the company's red flags, we should understand its background.

Background of Mishtann Foods:-

Mishtann Foods is involved in processing, manufacturing, and exporting various types of rice, including brown rice and basmati rice along with value-added products such as regular salt, rock salt, wheat, and pulses. The company has ventured into a different space & planned to establish an ethanol manufacturing facility.

Major allegations raised in SEBI’s order:-

Circular Trading:- There was a circular flow of funds between MFL and other group entities with the basic objective of inflating sales transactions. These transactions were designed with the false intent of deceiving the shareholders.

Sham Entities: Many of the buyers and suppliers didn't exist or were completely non-operational.

Mis-utilization of Proceeds of Rights issue:- The issue proceeds were transferred to promoter or director entities. Modus Operandi - MFL raised money in multiple smaller tranches through rights issues of amounts less than Rs. 50 crore to circumvent SEBI’s oversight and compliance with ICDR Regulations.

Manipulated Financial Statements: - There was no real business since there existed negligible fixed assets + low inventory + negative operating cash flow.

Red Flags:-

Negative Operating Cash Flows:- From the table below, it can be inferred that MFL had negative operating cash flow inspite of a substantial increase in sales.

Soaring Trade Receivable:- From the table below, it was also observed that the trade receivables increased exponentially by the end of the Sep-24 quarter, this constituted almost 97% of Total assets.

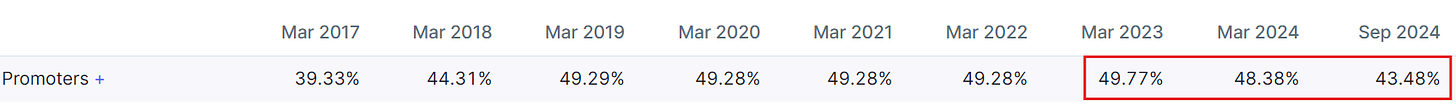

Reduction in Promoter Stake: The promoters significantly reduced their stake, which raised concerns about confidence in the company's future.

Related Party Transactions:- The group entities were involved in over 90% of sales & purchase transactions.

Though this story has ended here, there is one lesson to be learnt by every investor.

· Do not be greedy when you see money is made in seconds; it will lose too.

I hope you enjoyed reading. See you soon.